Welcome

This week we'll be diving into what some are calling DeFi 2.0. There's a new wave of DeFi products being built that are exploring new alternatives to traditional DeFi from Summer 2020. We will be going over the new core innovations and themes emerging from this movement, and explore what it could mean for the future of DeFi.

What is DeFi 2.0?

Within the world of DeFi, there are a core group of apps and protocols that lay the foundation for the financial building blocks we have today. Examples of these are Uniswap, MakerDAO, Compound, and Aave. These are not the same as those of DeFi 2.0. It's still unclear what DeFi 2.0 actually is because it still so new. That said, I see several forms in which DeFi 2.0 is taking shape: protocol owned liquidity (POL) and self-repaying loans (SRL).

Protocol Owned Liquidity

What is wrong with current models in DeFi?

Liquidity mining is the act of a protocol giving out its native token to users that provide it with capital. It's effective at accumulating, capital, but not long lasting because there are short term incentives. The issue with these programs is that they are diluting the supply of their native token for capital that is often temporary. These programs attract supporters of the project, but also attract predatory users looking to extract as much value as possible and then leave (see Chad DeFi Degen). Large holders of tokens can dump them and then pull out their deposited funds, leaving with a profit and the protocol with less liquidity. This causes a bank run on the protocol from panic sellers.

Why is protocol owned liquidity important?

POL differs from the older model of liquidity mining programs that incentivize users to provide funds in return for token rewards. One project that is experimenting with liquidity mining alternatives is OlympusDAO. Their mission is to create a decentralized reserve currency. They sell their token (OHM) for other tokens such as DAI, and they also accept liquidity provider (LP) tokens of pools that include OHM. This mechanism allows OlympusDAO's protocol to own its own liquidity. POL guarantees the market will have enough liquidity to facilitate buys and sells.

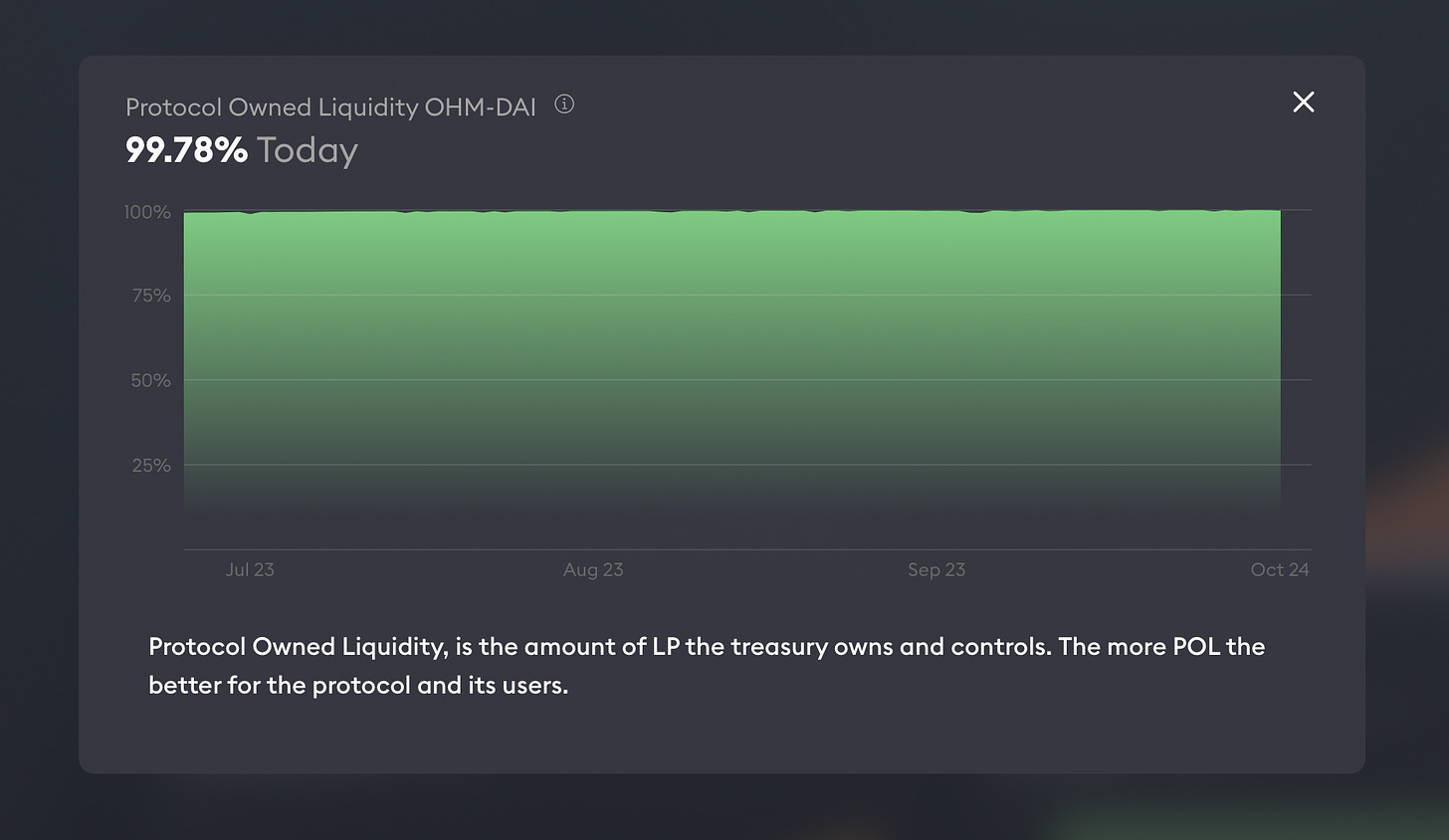

OHM can only be minted or burned by the protocol, which guarantees that the protocol can always back 1 OHM with 1 DAI. More runway is guaranteed for the stakers and investors as the protocol accumulates more protocol controlled value (PCV). The protocol currently owns ~99% of its liquidity. The Olympus protocol is also earning LP fees with the LP tokens it holds.

By being the largest LP, it earns most of the LP fees which represents another source of income to the treasury.

There is some skepticism around the mechanics of the Olympus protocol and wether it is a Ponzi scheme or not. There is a great scenario that explains what happens if there was ever a bank run on Olympus here. The mechanics of POL allow for a more sustainable form of liquidity within the market for the protocol.

Sustainability

This concept can be seen as a second order effect of the previously described protocol-owned liquidity. POL allows protocols to maintain steady growth, since the liquidity is not being drained from the system. Stable growth forages strong communities around these protocols because there is more confidence in their success. The relationship between the protocol and the users is less adversarial with POL as it removes the need for the protocol to rely on external users for capital.

Self Repaying Loans

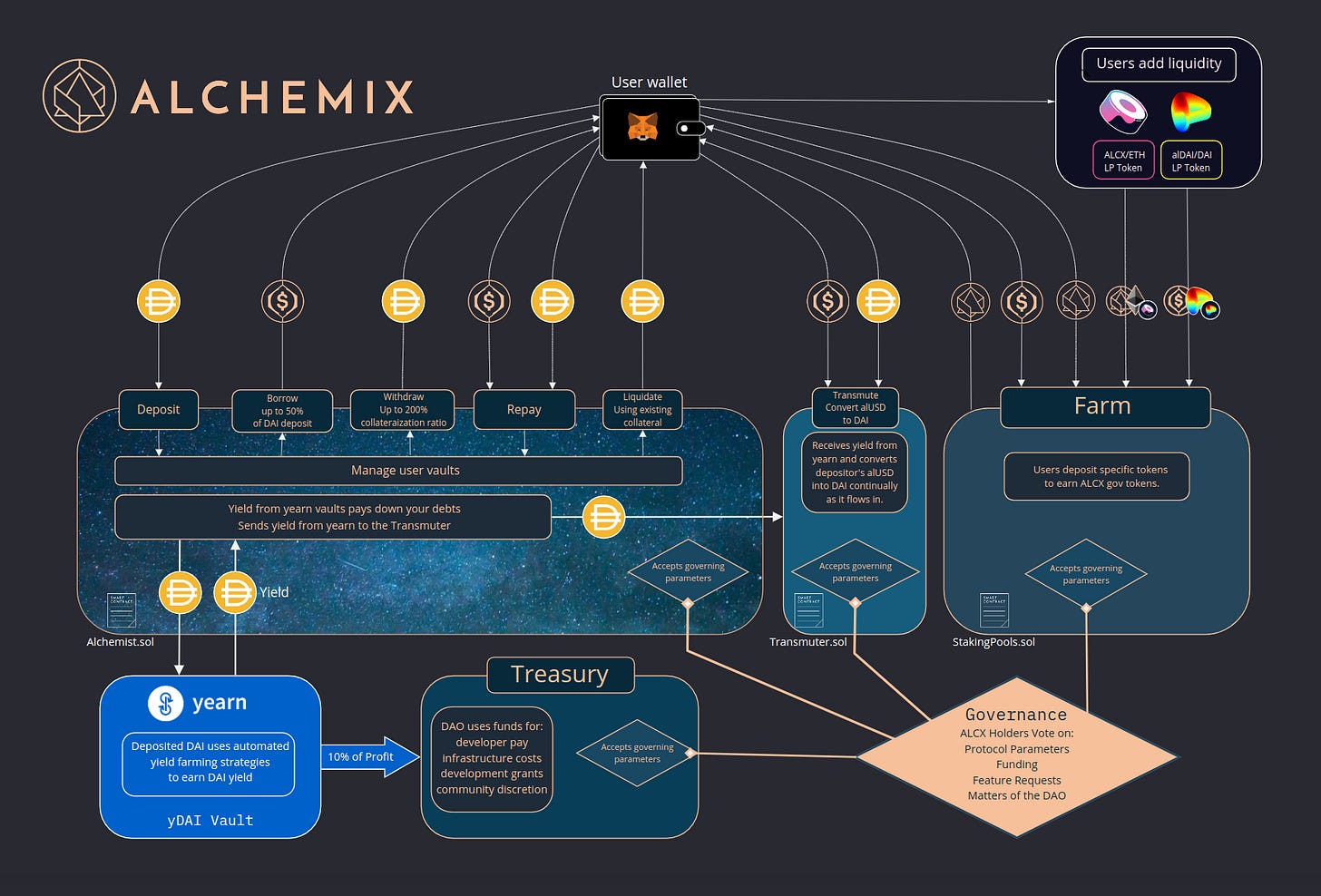

Self-repaying loans are a new primitive within in DeFi compared to others. Protocols like Alchemix have used this concept as a core piece of their product. In the case of Alchemix, users can deposit an amount of capital and receive up to 50% of that collateral’s value as a loan, and the deposited capital earns yield in Yearn vaults over time. That yield is then used to repay the loans of users in the system automatically. This allows people to take an advance on their future potential earning right away with the security that the loan will be repaid automatically.

The ability to take loans with the knowledge that they will be repaid by the system over time gives people much more financial flexibility with less downside risk. This primitive of DeFi 2.0 is laying the foundation for a more experimental environment with risk management built in.

Closing Thoughts

The rise of DeFi 2.0 is creating innovations around liquidity within DeFi protocols, finding alternatives to liquidity mining. These new alternatives are changing the relationship between providers of capital and the protocols they are providing these resources to. The experimentation happening within DeFi is indicative of a new generation of builders creating on top of the foundations laid before them by the bluechip protocols that defined DeFi summer. One or more of these new wave protocols will be the next major building block in the DeFi ecosystem which will enable even more future innovation. DeFi 2.0 is still in its nascency, and I am watching closely what happens next.

Rabbit hole Readings ✨🐇

Rari Capital (Another protocol a part of DeFi 2.0) and and article explains what Rari is here